Understanding Filing Status Under U.S. Tax Law

- T Anagesh

- Jul 31, 2025

- 8 min read

Updated: Oct 7, 2025

Filing status is the foundation upon which a taxpayer’s entire federal income tax return is built. It determines the standard deduction amount, applicable tax brackets, and eligibility for various tax credits and deductions. Choosing the correct status is not just about compliance it directly impacts how much you owe or how much you receive as a refund. For many individuals, especially those in changing personal or family situations, understanding the criteria for each status is essential to making informed decisions and avoiding costly mistakes.

This article explores the five IRS-recognized filing statuses in detail, explaining when they apply, how they affect tax calculations, and how real-life scenarios play out.

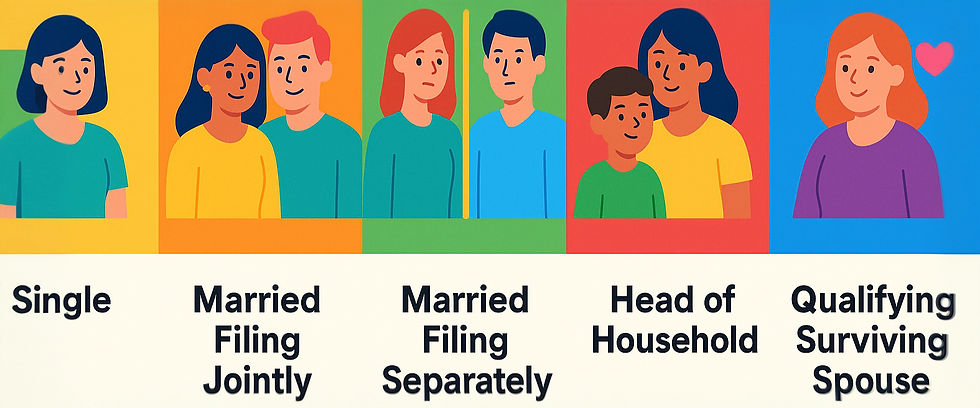

The Five Filing Statuses Defined

The Internal Revenue Service (IRS) categorizes taxpayers into five distinct filing statuses:

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Qualifying Surviving Spouse

Each status serves a specific segment of taxpayers based on their marital situation, household composition, and financial responsibility.

Filing as a Single Taxpayer

The "Single" filing status is designated for individuals who are unmarried at the end of the tax year. It is also the default status for those who are legally separated or divorced, and who do not qualify for any other filing category such as Head of Household.

A taxpayer who chooses this status typically has fewer dependents and simpler household arrangements. This status provides a lower standard deduction than some others and places the taxpayer into individual tax rate brackets. While straightforward, this status also excludes the taxpayer from tax benefits available to those supporting dependents or sharing income within a household.

Example:

David, age 35, is not married and lives alone. He has no dependents and supports himself entirely. As of December 31st, he is still unmarried and does not qualify for Head of Household. Therefore, he files his tax return using the Single status.

Filing as Married Filing Jointly

This status is available to individuals who are legally married as of the last day of the tax year and choose to file one combined tax return with their spouse. The joint return reports the income, deductions, and credits of both spouses together.

Filing jointly typically provides several tax advantages. It allows for the highest standard deduction available among all statuses and makes the couple eligible for a wide range of tax benefits, including the Earned Income Tax Credit (EITC), Child Tax Credit, and education-related deductions. Moreover, the income is taxed across broader tax brackets, often resulting in lower overall tax liability when compared to filing separately.

However, both spouses become jointly and severally liable for the return. This means each is fully responsible for the accuracy of the return and for any taxes owed, regardless of individual earnings.

Example:

Maria and Leo are married and both employed. Although Maria earns significantly more than Leo, they decide to file a joint return to take advantage of the higher standard deduction and combined credits. They are both equally responsible for any tax owed under this return.

Special Consideration:

If a taxpayer’s spouse passes away during the year, the surviving spouse can still file a joint return for that year, provided they did not remarry before year-end.

Filing as Married Filing Separately

Married couples also have the option to file separate returns. In this scenario, each spouse reports their own income, deductions, and credits independently from the other.

This option may be chosen for various reasons. Some couples prefer financial privacy or wish to avoid being jointly liable for each other’s taxes especially if one spouse has complex financial situations, unpaid taxes, or past legal issues. In other cases, one spouse may have significantly high deductions or liabilities that benefit from separate filing.

However, this filing status limits eligibility for several important tax benefits. For instance, the Earned Income Tax Credit and certain education credits are often unavailable or restricted. Also, if one spouse itemizes deductions, the other is not permitted to claim the standard deduction and must also itemize, even if they have no deductible expenses.

Example:

Jennifer and Thomas are legally married but live separately and maintain separate finances. Thomas owns a business with ongoing tax disputes. Jennifer, wanting to avoid joint liability, files her tax return using the Married Filing Separately status, even though it results in a higher overall tax.

Filing as Head of Household

Head of Household status is designed to support individuals who are not married (or are considered unmarried by IRS rules) and who are financially responsible for maintaining a home for qualifying dependents.

To qualify, a taxpayer must be unmarried or considered unmarried on the last day of the year, must have paid more than half the cost of maintaining their household, and must have a qualifying person, usually a child or close relative, who lived in the home for more than half the year. This status offers a higher standard deduction than the Single status and also provides access to favorable tax brackets and credit eligibility.

A taxpayer may be “considered unmarried” even if they are legally married, provided they did not live with their spouse during the final six months of the year and meet other specific requirements.

Example:

Rita is legally separated and lives with her 10-year-old daughter, whom she supports entirely. She pays for all housing costs and her daughter has lived with her the entire year. Although still legally married, Rita did not live with her spouse during the second half of the year. She qualifies for Head of Household status, which reduces her tax burden and provides eligibility for the Child Tax Credit.

Filing as a Qualifying Surviving Spouse

The IRS allows a surviving spouse to continue using tax benefits similar to the Married Filing Jointly status for up to two years following the year of their spouse’s death, provided certain conditions are met.

To use this filing status, the surviving spouse must:

Remain unmarried for the tax year

Have a dependent child (not a foster child) living with them all year

Pay more than half the cost of maintaining the household

Have been eligible to file jointly in the year the spouse died

This status provides the same standard deduction and tax brackets as Married Filing Jointly, offering significant financial relief during a difficult personal period. After two years, if the taxpayer has not remarried and still supports the dependent, they may qualify as Head of Household.

Example:

Robert’s wife passed away in 2023. He has a 7-year-old daughter who lived with him the entire year. Robert remains unmarried through 2024 and 2025. For both of those years, he can file as a Qualifying Surviving Spouse. In 2026, he may file as Head of Household if he continues to meet the support and household maintenance requirements.

Determining the Appropriate Filing Status

Filing status is based on a taxpayer’s situation as of December 31 of the tax year. When deciding which filing status to use, taxpayers should consider several factors:

Marital status at year-end

Whether they lived with their spouse

Whether they supported children or dependents

Who paid the majority of household expenses

Whether a spouse passed away during the tax year or prior years

Selecting the correct filing status is critical not only to calculate tax liability properly but also to ensure that the return is accepted by the IRS and that penalties are avoided. Filing under an incorrect status may delay refunds or prompt further inquiries.

Conclusion

Filing status plays a central role in shaping every taxpayer’s obligation and opportunity under the U.S. federal tax system. It affects how income is taxed, what deductions are available, and which credits can be claimed. From the simplicity of Single status to the extended benefits of Qualifying Surviving Spouse, each category serves to align tax rules with the taxpayer’s family and financial situation.

Because this decision influences nearly every part of the return, taxpayers should take care to assess their eligibility thoroughly, ideally with the help of a tax professional or IRS tools such as Publication 501 or the Interactive Tax Assistant. Making the right choice at the outset ensures accuracy, reduces audit risk, and often leads to better financial outcomes at tax time.

1. Can I change my filing status after filing my tax return?

Yes, you can amend your return using Form 1040-X if you filed under the wrong status. However, you must meet all eligibility criteria for the status you want to change to. Timely amendments may also help claim a refund or correct an overpayment.

2. If I got married on December 31, which status applies?

If you were legally married on the last day of the tax year, you are considered married for the entire year for tax purposes. You may file as Married Filing Jointly or Married Filing Separately, depending on your preference and circumstances.

3. What does “considered unmarried” mean for Head of Household purposes?

A taxpayer may be "considered unmarried" if:

They are legally married but did not live with their spouse during the last 6 months of the tax year,

They paid more than half the cost of maintaining the household, and

A qualifying dependent lived in the household for more than half the year.

In this case, the taxpayer may qualify for Head of Household even if they are not legally divorced.

4. What is the difference between Married Filing Jointly and Married Filing Separately?

When filing jointly, both spouses report their income and deductions on one return and are jointly liable for any tax due. Filing separately means each spouse files a separate return, reporting only their own income and deductions. However, filing separately can restrict access to credits like the Earned Income Credit or education credits.

5. How long can I use the Qualifying Surviving Spouse status?

You can file as a Qualifying Surviving Spouse for up to two years following the year of your spouse’s death, provided you have a dependent child living with you for the full year, you remain unmarried, and you meet other IRS eligibility conditions.

6. Can I claim Head of Household if my child doesn’t live with me full-time?

You can only claim Head of Household if the child lived with you for more than half the year. There are some exceptions for temporary absences (like school or medical care), but you must still provide the main home and financial support.

7. Can I file jointly if my spouse died during the year?

Yes. If your spouse died during the tax year and you did not remarry before December 31, you can still file as Married Filing Jointly for that year. In the two following years, you may be eligible for Qualifying Surviving Spouse status if you have a dependent child.

8. Which form do I use to file my tax return regardless of status?

All individual taxpayers, regardless of status, file Form 1040 as the base federal income tax return. Your filing status affects how the form is completed and what attachments are needed.

9. Which schedules are commonly used with Form 1040?

Depending on your income and deductions, you may need:

Schedule 1: For additional income (e.g., unemployment, business) and adjustments (e.g., student loan interest).

Schedule A: If you itemize deductions instead of claiming the standard deduction.

Schedule B: For interest and ordinary dividends.

Schedule C: For business income (sole proprietors).

Schedule D: For capital gains and losses.

Schedule 3: For claiming nonrefundable credits (like education or dependent care).

10. Which supporting forms apply to tax credits and dependents?

Form | Purpose |

Schedule 8812 | To claim the Child Tax Credit and Additional CTC |

Form 2441 | To claim the Child and Dependent Care Expenses Credit |

Form 8863 | To claim Education Credits (AOTC or Lifetime Learning) |

Form 8880 | To claim the Retirement Savings Contributions Credit |

Form 8958 | To allocate income in community property states when filing MFS |

11. Does my filing status affect my ability to claim certain forms or credits?

Yes. For example:

Married Filing Separately generally disqualifies or limits credits like the Earned Income Credit and the American Opportunity Credit.

Head of Household and Married Filing Jointly typically qualify for the widest range of tax benefits.

Single filers without dependents may still claim education and retirement credits but not dependent-based credits.

Comments